BA Business Major

The BA program is designed for students who have a strong interest in another discipline and wish to pursue their studies in that discipline as well as in business. If you have questions about or want to enroll in the undergraduate business program, please contact us to schedule an advising meeting.

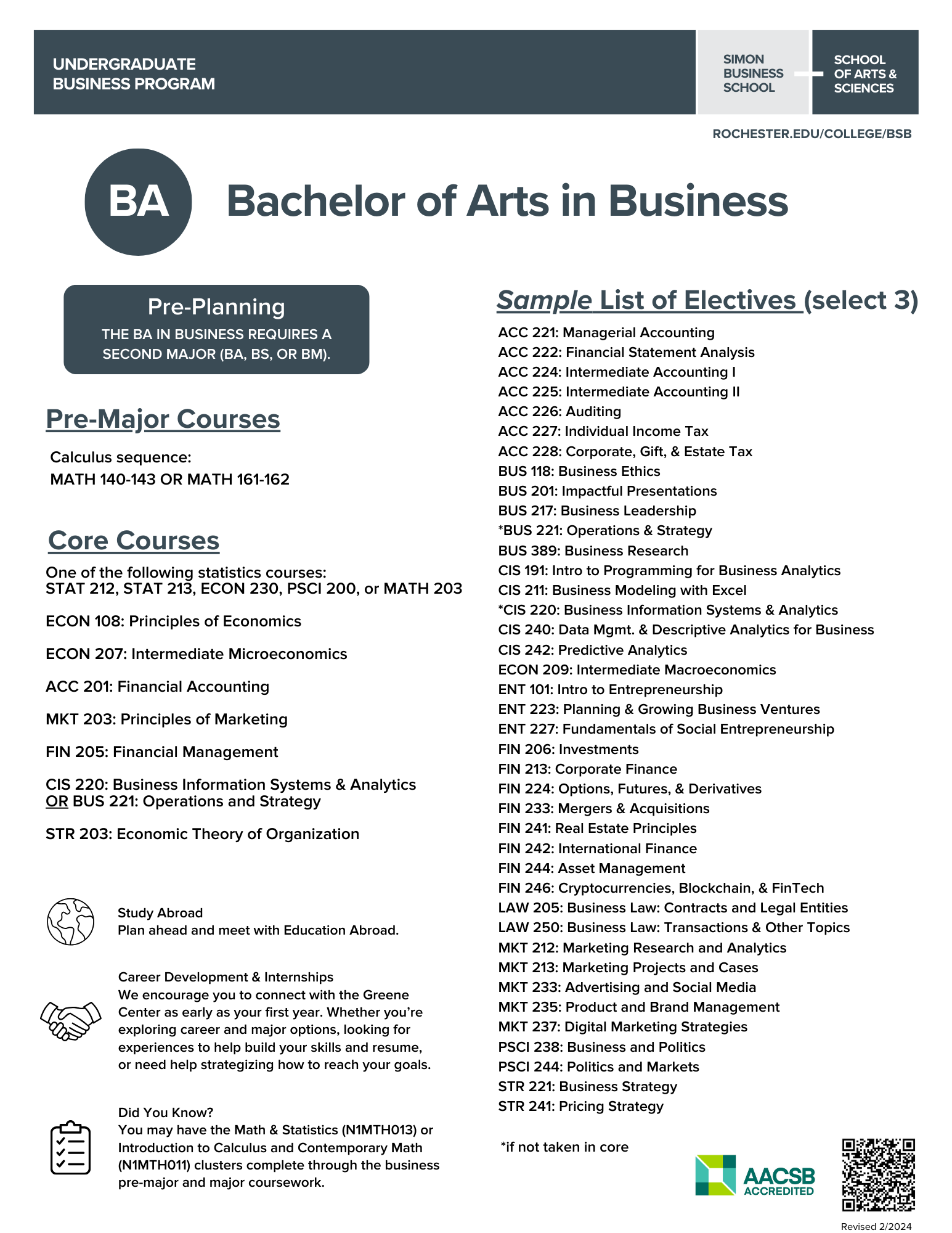

The BA degree in business consists of eleven courses with a pre-major requirement of the calculus series. The major satisfies the social sciences division of the Rochester Curriculum, and students must meet prerequisites and/or co-requisites for individual courses.

Requirements for a BA in business:

- Pre-major requirements in calculus (AP/IB credit is acceptable)

- Core set of eight required courses

- Three courses chosen from the approved elective list

- Must complete a second major (either a BA, BS, or BM degree)

Completing the required coursework above satisfies the College’s upper-level writing requirement.

Students are eligible to officially declare for the BA business major by submitting a major declaration form once all pre-major courses have been completed or are enrolled in the last calculus course in the sequence (MATH 143, MATH 162, or MATH 172).

One of the following calculus sequences or its equivalent:

- MATH 140-143

- MATH 161-162

- MATH 171–172

All of the following courses are required:

- One statistics course

- Select one: STAT 180*, STAT 190**, ECON 230, MATH 203***, PSCI 200, PSCI 205, or STAT 216

- ECON 108: Principles of Economics****

- ECON 207: Intermediate Microeconomics

- ACC 201: Financial Accounting

- FIN 205: Financial Management

- MKT 203: Principles of Marketing

- Either CIS 220 Business Information Systems or BUS 221 Operations and Strategy

- STR 203/ECON 214/ECON 214W: Economic Theory of Organizations

*STAT 180 was previously listed as STAT 212

**STAT 190 was previously listed as STAT 213

***MATH 201 is a prerequisite for MATH 203

****Students who received AP or IB credit for ECON 108 must take one additional higher-level ECON course.

Choose three of the following courses:

- ACC 221: Managerial Accounting (S)

- ACC 222: Financial Statement Analysis (S)

- ACC 224: Intermediate Accounting I (F)

- ACC 225: Intermediate Accounting II (S)

- ACC 226: Auditing (F)

- ACC 227: Individual Income Tax (F)

- ACC 228: Corporate, Gift, and Estate Tax (S)

- BUS 118: Business Ethics and Corporate Social Responsibility (every other S, even years)

- BUS 201: Impactful Presentations (S)

- BUS 217: Business Leadership (S)

- BUS 221: Operations and Strategy (if CIS 220 is taken in the core) (F/S)

- BUS 389: Business Research (S)

- CIS 191: Introduction to Programming for Business Analytics (F/S)

- CIS 211: Business Modeling Using Excel (F/S)

- CIS 220: Business Information Systems and Analytics (if BUS 221 is taken in the core) (F/S)

- CIS 240: Data Management and Descriptive Analytics for Business (F)

- CIS 242: Predictive Analytics (S)

- ECON 209: Intermediate Macroeconomics (F/S)

- ENT 101: Introduction to Entrepreneurship (F)

- ENT 223: Planning and Growing Business Ventures (S)

- ENT 227: Fundamentals of Social Entrepreneurship (every other S, odd years)

- FIN 206: Investments (S)

- FIN 213: Corporate Finance (F)

- FIN 233: Mergers and Acquisitions (S)

- FIN 241: Real Estate Principles (F)

- FIN 242: International Finance (F)

- FIN 244: Asset Management (S, odd years)

- FIN 246: Cryptocurrencies, Blockchain, & FinTech (S)

- LAW 205: Business Law: Contracts and Legal Entities (F)

- LAW 250: Business Law: Transactions, & Other Topics (S)

- MKT 212: Marketing Research and Analytics (F)

- MKT 213: Marketing Projects and Cases (F/S)

- MKT 233: Advertising and Social Media (S)

- MKT 235: Product and Brand Management (F)

- MKT 237: Digital Marketing Strategies (S)

- PSCI 238: Business and Politics (S)

- PSCI 244: Politics and Markets (S)

- STR 221: Business Strategy (S)

- STR 241/ECON 241: Pricing Strategy (F)

F= offered fall semester

S= offered spring semester

F/S= offered both fall and semesters

Students can use the following worksheets to help plan their courses: