Contribution

Contribution

Question 1 of 6

Which of the following is most consistent with your investment philosophy?

A portfolio will most likely...

Question 2 of 6

Possible Average Value at the End of the Year |

Chance of Losing Money at the End of the Year |

|

| Portfolio A | $106,000 | 16% |

| Portfolio B | $107,000 | 21% |

| Portfolio C | $108,000 | 25% |

| Portfolio D | $109,000 | 28% |

Question 3 of 6

Question 4 of 6

Question 5 of 6

Question 6 of 6

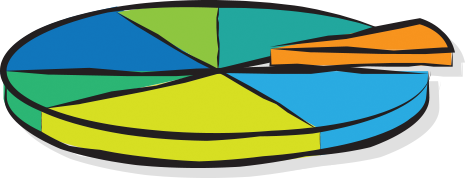

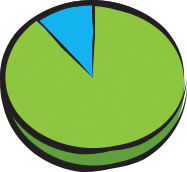

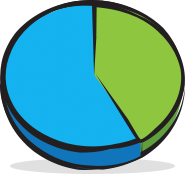

Risk Questionnaire Results: Aggressive

89% Equities

89% EquitiesStocks

11% Non-Equities

11% Non-EquitiesBonds (Fixed-Income)

Cash (Money Market)

Guaranteed

“I can stomach a big drop in my investments' value — even over several years — in pursuit of long-term growth.”

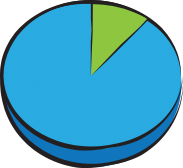

Risk Questionnaire Results: Conservative

17% Equities

17% EquitiesStocks

83% Non-Equities

83% Non-EquitiesBonds (Fixed-Income)

Cash (Money Market)

Guaranteed

“Downturns make me very nervous. I'll accept the lower long-term growth in exchange for rock solid stability.”

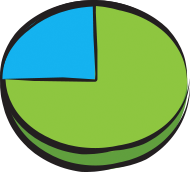

Risk Questionnaire Results: Moderately Conservative

37% Equities

37% EquitiesStocks

63% Non-Equities

63% Non-EquitiesBonds (Fixed-Income)

Cash (Money Market)

Guaranteed

“I can tolerate some volatility in a small portion of my investments for the chances of a higher return longer-term.”

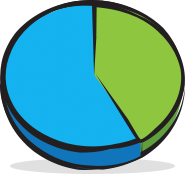

Risk Questionnaire Results: Moderately Aggressive

75% Equities

75% EquitiesStocks

25% Non-Equities

25% Non-EquitiesBonds (Fixed-Income)

Cash (Money Market)

Guaranteed

“I'm willing to accept greater volatility and risk by tilting my investments toward growth.”

Risk Questionnaire Results: Moderately Conservative

37% Equities

37% EquitiesStocks

63% Non-Equities

63% Non-Equities

Bonds (Fixed-Income)

Cash (Money Market)

Guaranteed

“I can tolerate some volatility in a small portion of my investments for the chances of a higher return longer-term.”

Conservative

| Usually seeks greater stability and lower level of risk. |

Moderately Conservative

| Usually seeks a balance between safety and growth, but still very concerned with preserving existing accumulations. |

Moderate

| Usually seeks a balance between safety and growth. |

Moderately Aggressive

| Probably willing to take somewhat more risk in pursuit of greater growth. |

Aggressive

| Probably comfortable with a higher level of risk to pursue growth potential. |

Equity

Equity

Non-equity

Non-equity

Question 1 of 3

Question 2 of 3

Question 3 of 3

Select Choice

Managed Funds, Annuities)

to market index

general market

income over lifetime

Brokerage

Account

Select Choice

Managed Funds, Annuities)

to market index

general market

income over lifetime

Brokerage

Account