UR Financials Newsletter Vol. 15 03.18.2024

In this issue:

- Workday Expenses (University only, excluding affiliates)

- Business purpose statement

- 60 day rule explanation

- MyPath resources for Workday Expenses module

- Expenses user group meetings: March 19th 3pm-4pm

- March topics

- Entry/Review items: business purpose statement, expense date, amount, etc.

- Approver review-research and send backs

- March topics

- Helpful links

Workday Expenses

- Business purpose statement

The Header memo is the expense report business purpose statement/justification and must comply with the IRS guidelines. The business purpose should be one to two sentences detailing the WHAT, WHEN, WHERE, and WHY for all expenses that are being reimbursed on the expense report. Attendee names and explanations for delay in submitting (60 day rule) should not be included in the business purpose statement. The business purpose of an expense may be obvious to the Payee and the Department Approvers, but not to a third-party reviewer. - 60 day rule explanation

Your explanation for the delay in submitting your business expenses should be added to the Comment section on the Workday Expense Report or you can attach a document with the explanation. The Expense Report approvers (department and financial) will review the explanation and determine if the expense(s) will be reimbursed. - MyPath resources for Workday Expenses module

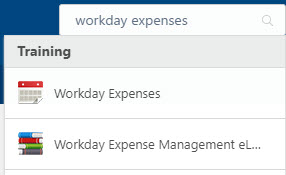

- eLearning self-paced course-type “workday expenses” in the MyPath search bar and select Workday Expense Management eLearning (book icon)

- Register for an Instructor Led Training session- type “workday expenses” in the MyPath search bar and select Workday Expenses (calendar icon). Select view details/request to register.

- Expenses user group meetings (held monthly)

Workday Expenses User group meetings are another opportunity intended to provide support for Expenses functionality to departments including information sharing, best practices, and tip/tricks. These meetings are more about discussing what is/is not working well to identify enhancement opportunities.Upcoming meetings:

Link to join meeting, https://rochester.zoom.us/j/96881056200- Tuesday, March 19th from 3:00pm-4:00pm

- Helpful Links

- Email Workday Expense inquiries to: Business_Expense_Reimbursement@finance.rochester.edu

- Workday Login: https://www.rochester.edu/adminfinance/urfinancials/workday-login/

- Link to Workday Expenses reference guides: https://www.rochester.edu/adminfinance/urfinancials/training/expense-management-training/expense-management-reference-materials/