UR Financials Newsletter Vol. 21 09.14.2024

In this issue:

- Workday Expenses (University only, excluding affiliates)

- Gift Cards given to employees and students

- Moving / Relocation reimbursement

- Helpful links

- Accounts Payable (University only, excluding affiliates)

- EFT Questionnaire

- Training sessions

- Tips and Tricks

- Buying and paying guide

- Accounting journal

Workday Expenses

- Gift Cards given to employees and students

From the Taxable Payments to Individuals policy:In lieu of cash received through Payroll an employee may wish to give gift certificates to other employees. Examples include Wegmans, Tops, Brueggers, mall and restaurant gift certificates or gift cards with a monetary value ($5, $10, $20, $100, etc.). In this situation, the employee who purchased the gift certificates and is requesting reimbursement will be responsible for the taxes associated with the reimbursement since the IRS considers gift certificates cash equivalent income. Therefore, reimbursement for the purchase of gift certificates must be processed through Payroll so that it is included on the employee’s Form W-2. Any request received in Accounts Payable to reimburse for the purchase of gift certificates will be returned for appropriate processing through division administration and Payroll. University policy requires alcohol expenses to be charged to the spend category SC49450. Since spend categories are linked to an Expense Item, alcohol amounts should be charged to the expense item Alcohol (EX239). This also applies when you use the Expense Item Entertainment (EX261).

- Moving / relocation reimbursement

From the Moving Policy:All moving expenses reimbursed beginning January 1, 2018, will be taxable to the employee and subject to tax withholding. Accordingly, beginning on 1/1/2018, all reimbursements of moving expenses to current or prospective employees should be reported to Payroll using a 211 form so that the appropriate taxes may be withheld from employee paychecks. This is true even if the expenses were incurred in a prior year, and the employee is not reimbursed until 2018. The University does not gross up any expense reimbursements to account for tax withholdings incurred on reimbursed expenses that are deemed taxable by the IRS.

- Helpful Links

-

- Email Workday Expense inquiries to: Business_Expense_Reimbursement@finance.rochester.edu

- Workday Login: https://www.rochester.edu/adminfinance/urfinancials/workday-login/

- Link to Workday Expenses reference guides: https://www.rochester.edu/adminfinance/urfinancials/training/expense-management-training/expense-management-reference-materials/Helpful Links

-

Accounts Payable

- EFT Questionnaire

The EFT Questionnaire was updated in July of this year. We ask that users start filling out the version of the questionnaire that appears in their Workday My Tasks as opposed to an older version they have saved, to ensure the right information is provided and to avoid send-backs that can delay payment processing. - Training sessions

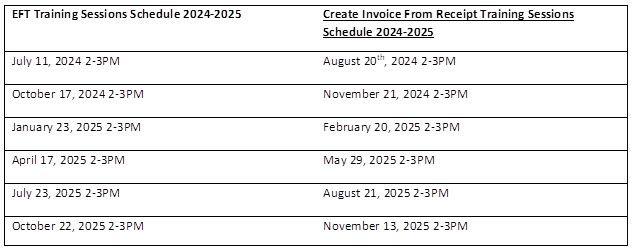

Accounts Payable has updated the zoom link for their quarterly EFT and Creating Invoice From Receipts Training Sessions. Please use https://rochester.zoom.us/j/3625131184?pwd=eS9iZ3BMa05WYlVDSmdsdms2RHlqZz09 for upcoming sessions. As a reminder, the complete 2024-2025 schedule is as follows:

Tips and Tricks

- Buying and paying guide

Before utilizing the Supplier Invoice Request process to pay for an invoice, take a look at the Buying and Paying Guide to ensure you are not submitting SIRs for activity that is not acceptable on a SIR. All qualified suppliers should be paid via the Requisition process unless the activity is acceptable on a SIR. You can find out if a supplier is qualified by going to the Supplier Record, then referring to the Overview-Summary tab to see if it’s in the “4 Qualified Supplier” Supplier Group. Accounts Payable will be sending back SIRs that should have been handled via the Requisition process if the supplier is qualified and your department has surpassed the 25K threshold. - How to research postings related to “Allocation” or “Recurring” journals

Log in to UR Financials website, go to Resources and Forms, then Allocation Contact or Recurring journal contacts. Each link provides the list of names for each department’s allocations and recurring journals. Please reach out to appropriate person related to each department as they will have the backup supporting these entries.