UR Financials Newsletter Vol. 27 03.17.2025

In this issue:

- Workday Expenses (University only, excluding affiliates)

- Enhancement: Expense Report Memos

- American Express Corporate Card Maintenance

- Receipts in a Foreign Language and Foreign Currency

- Default on Spend Authorization and Expense Reports

- Policy Clarification Topics

- Expenses User Group Meeting – Tuesday, March 18th 3:00-4:00pm

- Helpful links

- Accounts Payable (University only, excluding affiliates)

- Supplier Request Process Updates

- Email Invoices to Accounts Payable

- Placing Orders for Jaggaer Suppliers

- Match Exception Resolution

- Medline Website Orders

Workday Expenses

- Enhancement: Expense Report Memos

Workday Expense will trigger an error when the Memo fields are the same. The Memo on the Header page and the Memo(s) on the Expense Item Lines page should not be the same.- The Header Memo on page 1 of the expense report is the business purpose/justification statement. The business purpose statement must be specific enough that a third-party reviewer (auditor) can understand it. One to two sentences.

- The instructional text on the right side provides additional information.

- The Expense Item Line Memo on page 2 of the expense report is specific to the receipt. It is a brief description of the purchase. Each expense item line should have a different memo. Brief description of the item purchased. Maximum of 5 words

- Each expense item will display instructional text on the right side with information on entry.

- The Header Memo on page 1 of the expense report is the business purpose/justification statement. The business purpose statement must be specific enough that a third-party reviewer (auditor) can understand it. One to two sentences.

- American Express Corporate Card Maintenance

Employees should check their Expense Transaction report frequently to maintain their American Express Corporate Card transactions that automatically load to Workday within days of the charge/refund posting to their Amex corporate card account. Submit a workday expense to request reimbursement for business and travel expenses. The reimbursement funds should be used to pay your Amex balance, late fees are not allowable for reimbursement.- Summary of corporate card procedure:

- Charge business and travel expenses to the corporate card. There are no restrictions on the card, avoid using it to purchase personal expenses (ex: Netflix, family dinners, etc.)

- Save merchant receipt or request a copy of lost receipt (this is the required backup to request reimbursement). The Amex credit card statement is not the receipt, it is missing the detail of items purchased.

- Your charges, refunds and payments to Amex will load into your Workday account in the section “My Expense Transactions” within days of purchase.

- Frequently check your Workday account, mark payments made to Amex and personal expenses as CLOSED. The university does not reimburse for payments made to Amex or personal expenses. Only business expenses are allowable for reimbursement.

- At least one week before the Amex payment is due, create and submit a Workday expense report and include your credit card transactions.

- Once you receive your reimbursement from the University, submit payment to Amex for the statement balance. Late/delinquent fees are not allowable for reimbursement.

- The first date of travel for Conference Registration, Airfare, Hotel, and Car Rental. These items must be purchased well in advance of the trip. When you use the purchase date for these expenses you will unnecessarily trigger the 60-day rule. The expense date is the budget date listed on the ledger. Remember to change the expense date when you Itemize an expense line.

- Summary of corporate card procedure:

- Receipts in a Foreign Language and Foreign Currency

Receipts in foreign languages and foreign currency must be translated to English and the USD equivalent. Each receipt should be translated to English if the type of expense is not clear, indicating the type of purchase (ex: meal, transportation, supplies, hotel, etc.) AND the US dollar equivalency.- Reimbursement must be requested in US dollars at the exchange rate that was applied to the actual payment by the traveler.

- Purchase receipts will reflect the currency in which the purchase was made. Ex: CAN, EUR

- Debit/Credit card statements convert those amounts to US dollars and may list additional foreign currency fees. You do not need to use an online currency converter for debit or credit card purchases. The credit card company will automatically convert the transaction to USD.

- Foreign currency transaction fees are allowable for reimbursement.

- For expenses paid in foreign cash, the exchange rate at which the traveler bought the foreign currency applies, The purchase date on the receipt should be the date you enter on the currency converter.

- Currency converters: Google converter, OANDA.com, or search “currency converter”

- Defaults on Spend Authorizations and Expense Reports

The myURHR implementation impacted Spend Authorization and Expense Report defaults for Company and Worktags. Each task, Spend Authorization or Expense Report must be updated to avoid errors and frustration. When the company is 001 on a Spend Authorization, the user will NOT be able to link it to Expense Reports. Close the Spend Authorization, Create a New Expense Report, scroll down and select the credit card transactions for airfare from Deprez or Town & Country Travel.A Spend Authorization is NOT required to reconcile advanced airfare charges/refunds from Deprez or Town & Country Travel.

- Spend Authorization:

- Company: The default is 001 University of Rochester. The Company MUST match the Company for the FAO you anticipate charging upon return from your trip on a Workday Expense Report.

- Expense Report:

- Company– The default is 001 University of Rochester. The Company MUST match the Company for the FAO you want to charge.

- Worktags– The default is Fund: Current Fund-Unrestricted. Select the X next to Fund: Current Fund-Unrestricted to remove, then type the FAO you want to charge and hit enter. Workday will populate the Company, Cost Center, and Fund. The Worktags field must contain a minimum of 4 items: Company, Cost Center, Fund, and FAO.

- Spend Authorization:

- Policy Clarification Topics

Payees, Initiators, Managers, and Financial Approvers are responsible to comply with the IRS guidelines and the BETR policy. Expense Reports that do not comply with the BETR policy should be sent back for revision or Denied. Accounts Payable no longer reviews every expense report submitted in Workday.- Preferred payment method

- Conference registrations- department Pcard

- Supplier Invoices- Supplier Invoice Request (SIR), or Requisition

- Meal documentation

- Itemized receipt

- Transaction receipt

- List of attendees

- Alcohol amounts must be charged to Expense Item Alcohol

- Mileage reimbursement requests

- Completed Mileage Log Form

- Foreign currency purchases

- Each receipt must list a description of the purchase in English AND the US Dollar amount

- Acceptable Documentation

- merchant receipt is required for all purchases $50 or more. Debit/Credit card statements are not a substitute for a merchant receipt. Contact the merchant and request a copy of the receipt or check for an email copy. Pictures and scans of receipts are accepted. When a copy cannot be obtained, a completed Missing Receipt Form is required. Attach the Missing Receipt Form and proof of payment, debit/credit card transaction (statement)

Expense Date = the purchase date listed on the merchant receipt except for airfare, lodging, car rental, and conference registrations. For these items that are required to be purchased more than 60 days before travel use the first day of travel as the Expense Date to avoid triggering the 60-day warning in Workday Expense.

- merchant receipt is required for all purchases $50 or more. Debit/Credit card statements are not a substitute for a merchant receipt. Contact the merchant and request a copy of the receipt or check for an email copy. Pictures and scans of receipts are accepted. When a copy cannot be obtained, a completed Missing Receipt Form is required. Attach the Missing Receipt Form and proof of payment, debit/credit card transaction (statement)

- Preferred payment method

- Expenses user group meetings (held monthly)

Workday Expenses User group meetings are another opportunity intended to provide support for Expenses functionality to departments including information sharing, best practices, and tip/tricks. These meetings are more about discussing what is/is not working well to identify enhancement opportunities. Upcoming meetings:

Link to join meeting, https://rochester.zoom.us/j/97336120393

This month’s meeting will be held on Tuesday, March 18th, 2025 3:00-4:00pm-

- Presentation slides and recordings for prior meetings are located here: https://www.rochester.edu/adminfinance/urfinancials/training/expense-management-training/expense-management-training-schedule/expense-management-workshops/expense-management-user-meetings/

-

- Helpful Links

- Email Workday Expense inquiries to: Business_Expense_Reimbursement@finance.rochester.edu

- Workday Login: https://www.rochester.edu/adminfinance/urfinancials/workday-login/

- Link to Workday Expenses reference guides: https://www.rochester.edu/adminfinance/urfinancials/training/expense-management-training/expense-management-reference-materials/

Accounts Payable

- Supplier Request process updates

The Supplier Request process has been updated to include a Questionnaire. These changes will take effect on 3/13/2025. In line with these changes, we have also updated the Guide To Creating a Supplier Request. Please familiarize yourself with the Questionnaire by reading through all questions and the details for each. If you need further assistance, please contact Procurement_Service_Center@ur.rochester.edu. - Email Invoices to Accounts Payable

Invoices you may attach as supporting documentation when creating Requisitions in Workday do not come to Accounts Payable for processing. Once your Requisition has been approved, it’s status will change to “Closed”. At that time, you should drill into the Requisition Information, refer to the Purchase Order Number that has been generated, and email your invoice to AP with that PO Number noted on the invoice itself, ensuring you follow the Guidelines for Emailing Invoices to Accounts Payable. - Placing orders for Jaggaer suppliers

If a supplier is in the “4 Jaggaer Enabled” Supplier Group, you should be placing orders using the Marketplace. Placing orders by giving the supplier your name, a date, your FAO, etc. as the Purchase Order Number means AP won’t be able to process your invoices. The only time you should use your FAO/SC is if your department has been granted an exception by Corporate Purchasing. - Match Exception resolution

Checking your My Tasks at least once a week for match exceptions awaiting your action is important so that invoices are resolved and can be paid within their respective due dates. The Help Text will guide you as to what triggered the match exception and how you can resolve it. We have also provided links to resources and contact information if you need additional help.- Please do not pull a copy of an invoice that is in match exception awaiting your action and send it to AP for processing. If you receive a match exception for that invoice, it means AP already received it and processed it which is how it routed to you.

- Medline Website Orders

If you place orders via the Medline website, you must provide your Spend Category and FAO in this format: SCxxxxxOPxxxxxx or SCxxxxxGRxxxxxx if using a Grant FAO. Any other variation, including but not limited to giving your name, a date, etc. is unacceptable and causes issues with invoicing. - Tips and Tricks

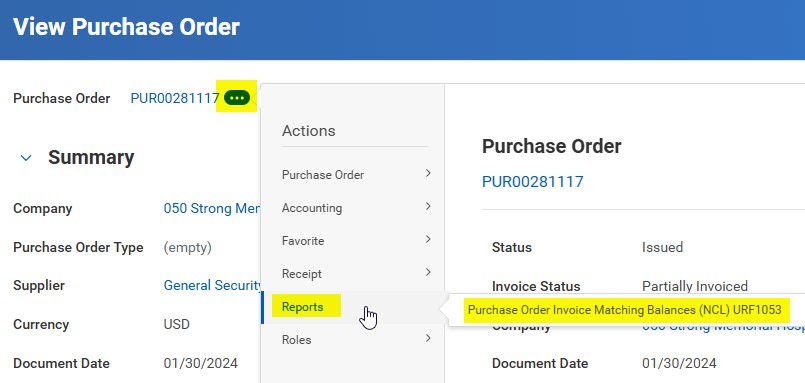

You can utilize Purchase Order Invoice Matching Balances (NCL) URF1053 to see what has been ordered, invoiced and received on one of your Purchase Orders. You can either search for this report in Workday, or go to your PO’s Related Actions, hover over Reports, then click on the resulting report. This can also assist you with clearing your receipt match exceptions.

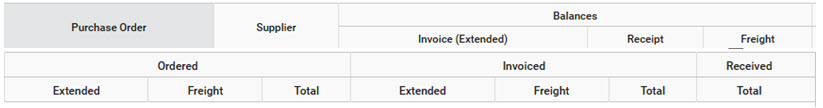

- The report output provides the following details: