UR Financials Newsletter Vol. 28 04.23.2025

In this issue:

- Workday Expenses (University only, excluding affiliates)

- Fuel/Gas Reimbursements

- Spend Authorizations and Expense Reports created before myURHR implementation, 12/16/2024

- Expense report review/approval

- Receipts in a Foreign Language and Foreign Currency

- Expenses User Group Meeting – Tuesday, May 20th 3:00-4:00pm

- Helpful links

- Accounts Payable (University only, excluding affiliates)

- Research Subject Payments Policy

- Tips and Tricks

Workday Expenses

- Fuel/Gas reimbursements

Travelers can request reimbursement for Fuel OR Mileage. Fuel is not allowable for reimbursement when a mileage reimbursement is requested. The IRS mileage rate covers costs for fuel, maintenance, repairs, and insurance for personal vehicles when used for business. - Spend Authorizations and Expense Reports created before myURHR implementation, 12/16/2024

The myURHR implementation has affected users’ ability to copy previous expense reports and link SPA’s that were created before 12/16/2024. An error will trigger when you try to link a SPA created before 12/16/24. The only way to fix the error is to cancel the expense. I recommend closing all spend authorizations created before 12/16/2024 and not copying expense reports created before 12/16/2024.

You do not have to create an expense report from a spend authorization to clear the advanced airfare charges. You can create a new expense report and add the credit card transactions for airfare. You can add the SPA # to the business purpose statement as a reference. After the expense report is submitted you can manually close the spend authorization. - Expense report review/approval

The payee, initiation delegate, and expense report approvers are responsible to review expense reports to ensure:- Compliance with policies

- Business Purpose statement, justification for reimbursement request

- Duplicates

- Explanation for the delay in submission for expenses that are dated older than 60 days

- Attached receipts match the amount requested

- Alcohol is separated from Food for all meals

- List of attendees for all group meals

- Receipts in a Foreign Language and Foreign Currency

Receipts in foreign languages and foreign currency must be translated to English and the USD equivalent. Each receipt should be translated to English if the type of expense is not clear, indicating the type of purchase (ex: meal, transportation, supplies, hotel, etc.) AND the US dollar equivalency.- Reimbursement must be requested in US dollars at the exchange rate that was applied to the actual payment by the traveler.

- Purchase receipts will reflect the currency in which the purchase was made. Ex: CAN, EUR

- Debit/Credit card statements convert those amounts to US dollars and may list additional foreign currency fees. You do not need to use an online currency converter for debit or credit card purchases. The credit card company will automatically convert the transaction to USD.

- Foreign currency transaction fees are allowable for reimbursement.

- For expenses paid in foreign cash, the exchange rate at which the traveler bought the foreign currency applies, The purchase date on the receipt should be the date you enter on the currency converter.

- Currency converters: Google converter, OANDA.com, or search “currency converter”

- Expenses user group meetings (held monthly)

Workday Expenses User group meetings are another opportunity intended to provide support for Expenses functionality to departments including information sharing, best practices, and tip/tricks. These meetings are more about discussing what is/is not working well to identify enhancement opportunities. Upcoming meetings:

Link to join meeting, https://rochester.zoom.us/j/97336120393

This month’s meeting will be held on Tuesday, March 20th, 2025 3:00-4:00pm-

- Presentation slides and recordings for prior meetings are located here: https://www.rochester.edu/adminfinance/urfinancials/training/expense-management-training/expense-management-training-schedule/expense-management-workshops/expense-management-user-meetings/

-

- Helpful Links

- Email Workday Expense inquiries to: Business_Expense_Reimbursement@finance.rochester.edu

- Workday Login: https://www.rochester.edu/adminfinance/urfinancials/workday-login/

- Link to Workday Expenses reference guides: https://www.rochester.edu/adminfinance/urfinancials/training/expense-management-training/expense-management-reference-materials/

Accounts Payable

- Research Subject Payments Policy

Using feedback from researchers and their support staff, as well as data on study payments, Accounts Payable, Tax Department, ORPA, ORACS, RSRB, and OCR proposed a new policy which will soon be reflected in the Research Subject Payments Policy located in the Accounts Payable website under Policies.Per this update, if any research subject receives payments of $500.00 or more in any single calendar year from the research study, the faculty/department person shall collect information from the recipient (i.e., a Form W9) and immediately forward to Accounts Payable for retention.

Benefits include but are not limited to:

- Improves efficiency: Reduces administrative burden of support staff, reducing the volume of W9s they need collect

- Improves researchers’ ability to expand their pool of research subjects and attract subjects who would otherwise not participate

Other enhancements to the policy includes: updated wording per current nomenclature, new and improved definitions, a Contacts table for additional support, topics on Reimbursements and Transfer of Items, outline of Payment Types, and hyperlinks to other policies, forms, and reference guides.

- Tips and Tricks

Referring to the Help Text when handling Match Exceptions assigned to you, Supplier Requests you submit, SIRs you submit, etc is beneficial to you as it allows you to see steps needed to complete an action, additional resources you can use, as well as who to contact and their contact information if you need additional assistance.

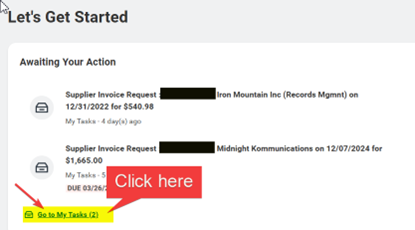

It is important to go to your My Tasks to see the Help Text as opposed to just viewing it from your Homepage in the Awaiting Your Action summary (this won’t show you any details).

Match Exceptions: There are several types of match exceptions, and the Help Text for each is different. Refer to it before sending invoices back to Accounts Payable which only delays resolution of that match exception.

Supplier Requests: If these are sent back to you or you attempted to submit it and due to a critical error the system didn’t allow you to do so, using the Help Text in your My Tasks will help you understand what action to take.

Supplier Invoice Requests: If you leave a SIR in draft status, or if a SIR is sent back to you by one of the approvers, or if you attempted to submit the SIR but a critical error prevented you from being able to do so, using the Help Text in your My Tasks will help you understand what action to take.