UR Financials Newsletter Vol. 6 06.15.2023

In this issue:

- FY2023 June year-end close schedule

- Workday Expenses (University only, excluding affiliates)

- FY2023 expense report deadlines

- Workday expense reimbursements

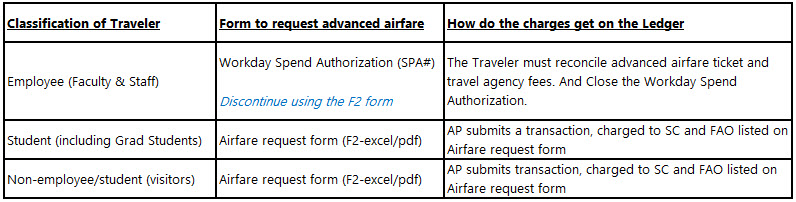

- What form do I use to request airfare from Deprez or Town & Country

- Advanced airfare reconciliation

- Accounts Payable (University only, excluding affiliates)

- FY2023 invoice deadlines

- Change orders for Workday purchase orders

FY2023 June Year-end Close Schedule

Reminder: Please refer to this schedule on important deadlines

Workday Expenses

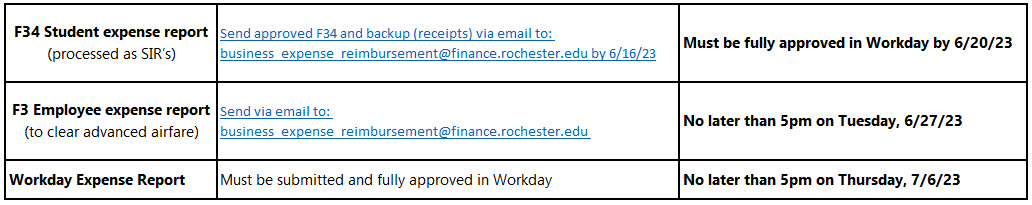

- FY2023 Expense report deadlines

Reminder of the deadline for expenses to be charged in fiscal year 2023.

- Workday expense reimbursements

Workday Expense Report reimbursements will no longer show on your paystub. Accounts Payable no longer uses HRMS to process reimbursements. Your bank has two business days after the payment (processing) date listed on your Expense Report in Workday to make the funds available in your bank account.Link to reference guide: How to check the status of your Workday expense report - What form do I use to request airfare from Deprez or Town & Country?

- Advanced airfare reconciliation

Employees who have used Deprez or Town & Country Travel should log into HRMS and check their Travel & Expense record for outstanding advances that need to be cleared.- Plan A Preferred

The Employee traveler/Department emailsbusiness_expense_reimbursement@finance.rochester.edu with the information and documentation to clear the advance. - Otherwise Plan B

Accounts Payable reviews the outstanding advance list and Workday Expense Report list to see if the trip has been taken. If an Expense Report has been submitted for the trip, Accounts Payable will clear the advance in HRMS or via Journal Entry using the Expense Report number (EXP) as the reference. - Otherwise Plan C

When the return date of the trip is more than 60 days old AND Plan A or B has not occurred (no documentation of the trip submitted), Accounts Payable will follow standard procedure to notify the Traveler that the amount will be added to their W2 taxable income unless documentation is provided within 120 days of the return date of the trip

- Plan A Preferred

Accounts Payable

- FY2023 Invoice Deadlines

Supplier Invoices, Supplier Invoice Requests, F4 Payment Requests, and Journal Entry requests related to AP errors must be received in Accounts Payable no later than 5PM on Friday June 23, 2023. Supplier Invoices, F4 Payment Requests, and Journal Entry requests related to AP errors can be approved electronically and should be emailed to AccountsPayable@finance.rochester.edu.Departments should monitor their Workday match exceptions, In Progress SIRs and discrepancies assigned to them in ASC to ensure invoices post to the correct fiscal year. If Accounts Payable has requested your approval on an invoice, please respond with your approval before the deadline. If Accounts Payable has asked that you process a change order for a PO to allow us to enter invoice(s), please follow up on that change order asap to ensure your invoices post to the correct fiscal year. - Change Orders for Workday Purchase Orders

We are noticing an increase in unaddressed requests by departments in regards to change orders needed to allow us to process your invoices. If you receive an email from Accounts Payable staff letting you know we cannot process an invoice due to the PO being out of funds or an item is not listed on the PO, it is your responsibility to submit that change order asap to avoid delays with payment, which affect our relations with suppliers.