Page 6 - Five Strategies | University of Rochester

P. 6

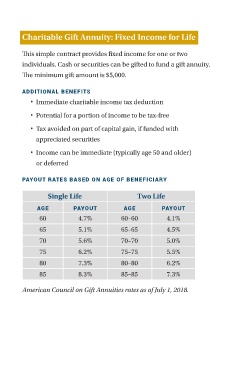

Charitable Gift Annuity: Fixed Income for Life

This simple contract provides fixed income for one or two

individuals. Cash or securities can be gifted to fund a gift annuity.

The minimum gift amount is $5,000.

ADDITIONAL BENEFITS

• Immediate charitable income tax deduction

• Potential for a portion of income to be tax-free

• Tax avoided on part of capital gain, if funded with

appreciated securities

• Income can be immediate (typically age 50 and older)

or deferred

PAYOUT RATES BASED ON AGE OF BENEFICIARY

Single Life Two Life

AGE PAYOUT AGE PAYOUT

60 4.7% 60–60 4.1%

65 5.1% 65–65 4.5%

70 5.6% 70–70 5.0%

75 6.2% 75–75 5.5%

80 7.3% 80–80 6.2%

85 8.3% 85–85 7.3%

American Council on Gift Annuities rates as of July 1, 2018.