Page 8 - Six Strategies | Wilson Society | Eastman School of Music

P. 8

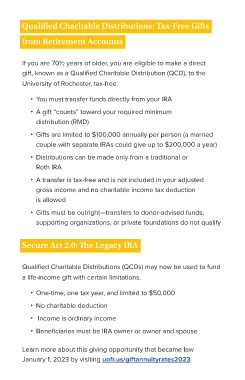

Qualified Charitable Distributions: Tax-Free Gifts

from Retirement Accounts

If you are 701/2 years of older, you are eligible to make a direct

gift, known as a Qualified Charitable Distribution (QCD), to the

University of Rochester, tax-free.

• You must transfer funds directly from your IRA

• A gift “counts” toward your required minimum

distribution (RMD)

• Gifts are limited to $100,000 annually per person (a married

couple with separate IRAs could give up to $200,000 a year)

• Distributions can be made only from a traditional or

Roth IRA

• A transfer is tax-free and is not included in your adjusted

gross income and no charitable income tax deduction

is allowed

• Gifts must be outright—transfers to donor-advised funds,

supporting organizations, or private foundations do not qualify

Secure Act 2.0: The Legacy IRA

Qualified Charitable Distributions (QCDs) may now be used to fund

a life-income gift with certain limitations.

• One-time, one tax year, and limited to $50,000

• No charitable deduction

• Income is ordinary income

• Beneficiaries must be IRA owner or owner and spouse

Learn more about this giving opportunity that became law

January 1, 2023 by visiting uofr.us/giftannuityrates2023.