UR Financials Newsletter Vol. 19 07.16.2024

In this issue:

- Workday Expenses (University only, excluding affiliates)

- Business Mileage

- When an expense report is mistakenly approved

- Expenses user group meetings: July 16th 3pm-4pm

- July topics

- Expense report status review: draft, in-progress, approved, paid

- How to edit a Expense report

- What to do when an employee leaves the University: delegation, security form

- July topics

- Helpful links

- Accounts Payable (University only, excluding affiliates)

- Updated version of the EFT Questionnaire for SIR and PO invoices and Workday Foreign-EFT Payment Questionnaire Guide

- Spend and Revenue Category Definitions

- Training Session via Zoom – August 20th 2pm-3pm

- Create Invoice from Receipt

- Tips and tricks

Workday Expenses

- Business Mileage

Business mileage is the number of miles driven between two places of work using your personal vehicle. Commuting mileage is the number of miles between your home and a workplace and not allowable for reimbursement. A completed Mileage Log Form is the required documentation (receipt) when requesting a mileage reimbursement. The IRS reimbursement rate includes Fuel/Charging fees, Vehicle maintenance, Insurance, Operating costs.Expenses that are allowable for reimbursement separate from the mileage rate include Parking and Tolls.

Expenses that are not allowable for reimbursement-Mileage associated with commuting between your home and work location, damage, deductibles, or other losses to personal vehicle used for University business. Repairs for damage to personal vehicle, parking fines and traffic tickets or related fees/fines.

- When an expense report is mistakenly approved

The employee who mistakenly approved the expense report should immediately contact the payee. Notify the payee that their expense report was mistakenly approved and needs to be fixed asap. The payee can change (edit) the expense report and make any necessary changes then resubmit for approval and processing. Or the payee can cancel the expense report, Workday does not allow a expense report to be deleted. - Expenses user group meetings (held monthly)Workday Expenses User group meetings are another opportunity intended to provide support for Expenses functionality to departments including information sharing, best practices, and tip/tricks. These meetings are more about discussing what is/is not working well to identify enhancement opportunities. Upcoming meetings:

Link to join meeting, https://rochester.zoom.us/j/96881056200- Tuesday, July 16th from 3:00pm-4:00pm

- Helpful Links

-

- Email Workday Expense inquiries to: Business_Expense_Reimbursement@finance.rochester.edu

- Workday Login: https://www.rochester.edu/adminfinance/urfinancials/workday-login/

- Link to Workday Expenses reference guides: https://www.rochester.edu/adminfinance/urfinancials/training/expense-management-training/expense-management-reference-materials/Helpful Links

-

Accounts Payable

- July 2024Be on the lookout for an updated version of the EFT Questionnaire for your SIR and PO invoices that require an EFT payment, as well as the updated Workday Foreign-EFT Payment Questionnaire Guide located in the Accounts Payable webpage under Procedures and Resources. The guide can also be located in the Procurement website as usual.

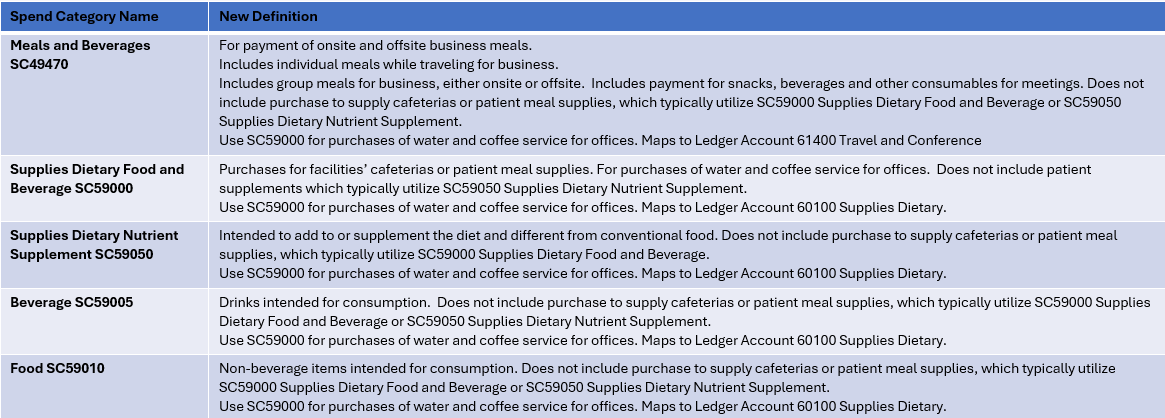

- Spend and Revenue Category Definitions have been updated in an effort to clarify differences between spend categories with similar names, share best practice spend category usage, related preferred purchasing methods, etc. These new definitions also include information about Form 1099 reporting if applicable as well as Ledger Account mapping where it may help to decide between similar SCs. The updates are summarized below but please refer to the link above for a full listing.

- Training Session via Zoom

Accounts Payable will be providing another training session on Create Invoice From Receipt functionality on August 20th from 2-3PM. We encourage users who are currently utilizing this functionality as well as users who aren’t but would be interested in doing so to attend. Your feedback on process and/or guide enhancements is also welcomed. Zoom link: https://rochester.zoom.us/j/97952631824 - Tips and Tricks

When initiating a change order with reason code “Add Money to Service Line”, you should ensure you either increase the value of the existing PO line(s) or add a new PO line. Submitting a change order with this reason without actually increasing the value of the PO will not add money to the PO.