The University of Rochester Medical Center comprises the largest share of the endowment. Arts, Sciences & Engineering and the Eastman School of Music share the next two largest segments of the endowment. The Simon Business School, Warner School of Education and Human Development, and the Memorial Art Gallery collectively represent about 6% of the endowment. Approximately 6% of the endowment is from unrestricted gifts that are designated by the Board of Trustees as permanent support for Arts, Sciences & Engineering. The growth of endowment through philanthropy helps ensure predictable budget support for education, the arts, and patient care.

Endowment at a Glance

Long Term Investment Pool Components as of June 30, 2024

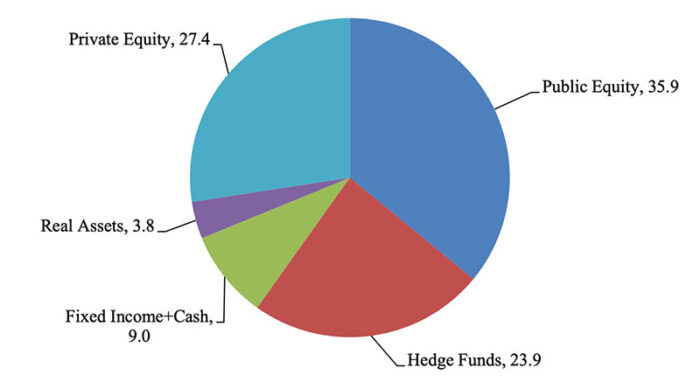

Asset Allocation as of June 30, 2024

Rochester’s portfolio maintains a balance of domestic and foreign equities and fixed income as well as investments in private equity, hedge funds, real estate, and other assets that typically do not trade on public markets. The portfolio is divided into 45% traditional publicly traded assets—stocks and bonds—and 55% non-publicly traded investments, referred to as “alternative investments.” This approach has ensured growth, with volatility below public markets, during economic expansions and capital preservation in economic downturns.

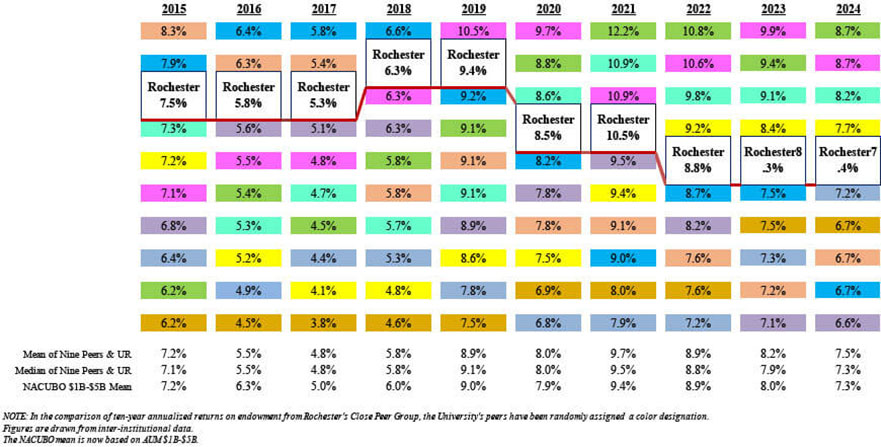

10-Year Annualized Fiscal Year-end Returns

Rochester vs Close Peer Group

Naveen Nataraj ’97

Naveen and Courtney Nataraj’97 commit $1 million to the Together for Rochester diversity