Performance Reports

Long Term Investment Pool

Fiscal 2024 Report

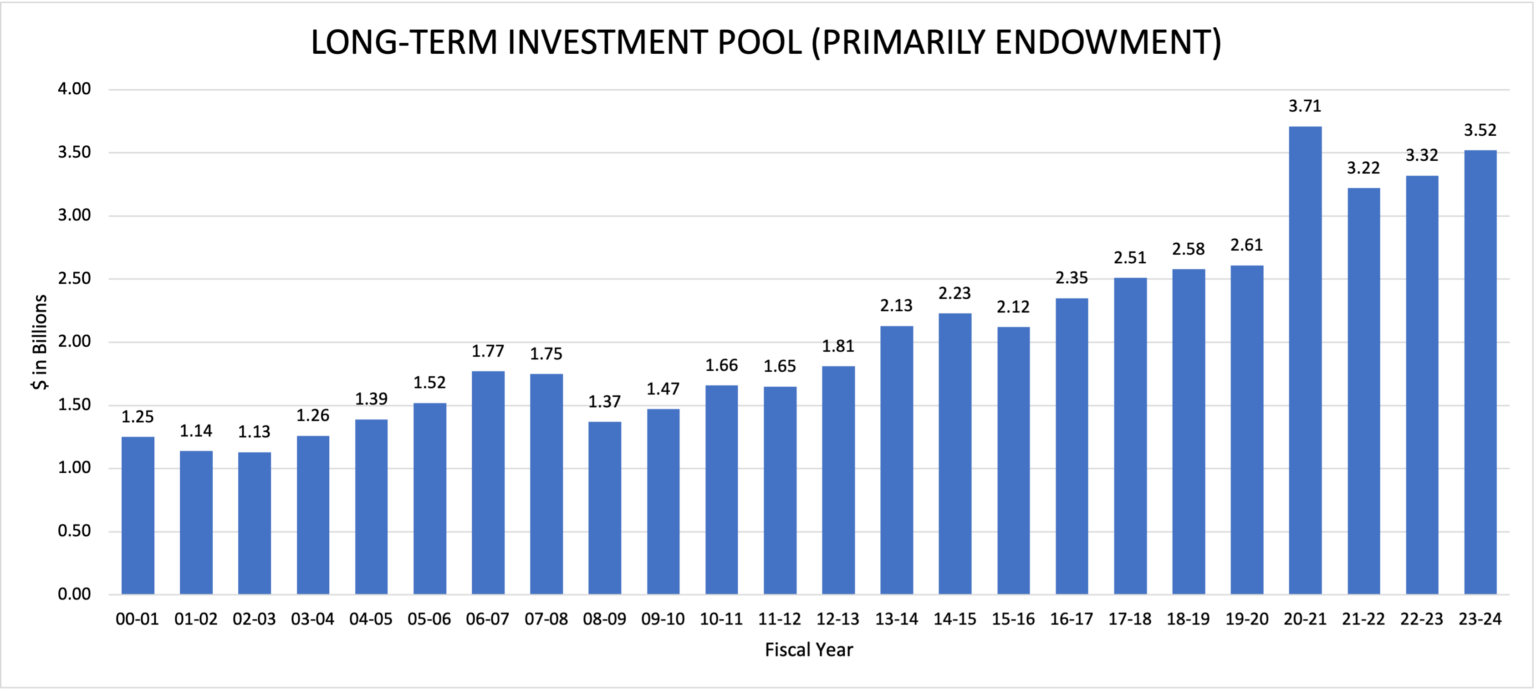

On June 30, 2024, the market value of the University of Rochester’s Long Term Investment Pool (“LTIP”) was $3.5 billion. Performance for the fiscal year was 9.5%, net of all fees and expenses, compared with the benchmark return of 16.5%. The performance of the LTIP exceeded the benchmark for ten years but lagged for one, three, and five years. The recent lag was primarily caused by the rapid increase in the equity benchmark from the price frenzy in the “Magnificent 7” stocks (artificial intelligence) and a slightly negative three-year return on private partnerships. Private partnerships remained the LTIP’s best-performing asset class for five and ten years.

Calendar 2024 Report

On December 31, 2024, the market value of the University of Rochester’s Long Term Investment Pool (“LTIP”) was $3.6 billion. Performance for the calendar year was 10.5%, net of all fees and expenses, compared with the benchmark return of 14.8%. Performance excludes fourth-quarter results from approximately 30% of the LTIP that is invested in partnerships. Partnership values are lagged by one quarter such that December 31 values will be included in March quarterly performance.

Annualized Performance through Calendar 2024

Additional endowment information may be found on our Endowment At A Glance page. We also archive our annual performance reports on our Investment Report Archives page.