Fiscal 2021 Report

Report on Investment Performance for the fiscal year ending June 30, 2021

On June 30, 2021, the market value of the University of Rochester’s Long Term Investment Pool (“LTIP”) was $3.7 billion. Performance for the fiscal year was 41.7%, net of all fees and expenses, compared with the benchmark return of 30.7%. Performance of the LTIP exceeded the benchmark, net annualized, for three, five, and ten years.

Asset Allocation and Performance

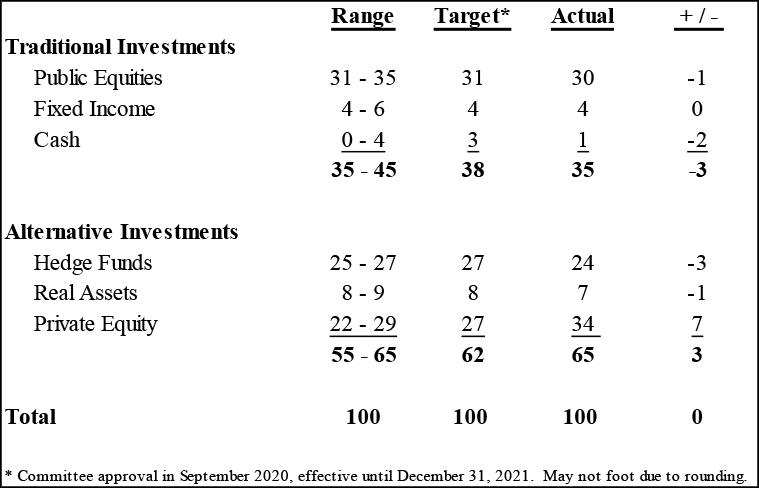

The table below shows the LTIP’s June 30, 2021 allocations compared to targets and ranges for calendar year 2021.

The LTIP’s 65% alternative investment allocation, consisting of hedge funds and private equity and real asset partnerships, outperformed the LTIP and its benchmark for all periods. For the fiscal year, private equity (including venture capital) returned 82.8%. The real assets portfolio returned 11.8%. The hedge fund portfolio returned 20.6%. Volatility of return for the alternatives program was 6.0% annualized for the ten years ending June 30, 2021. This compares to ten-year volatility of 6.6% for the LTIP and 11.1% for the LTIP benchmark.

The publicly-traded equity portfolio returned 40.4% for the fiscal year, above the 39.3% return for the ACWI benchmark. The fixed income and cash portfolio returned 5.0% for the fiscal year, compared to the 0.4% return for the benchmark BB Gov’t/Credit 1-3 Year Index.

The LTIP has ample liquidity, with approximately 50% of its value convertible into cash within one year.

Comment on Asset Category Performance

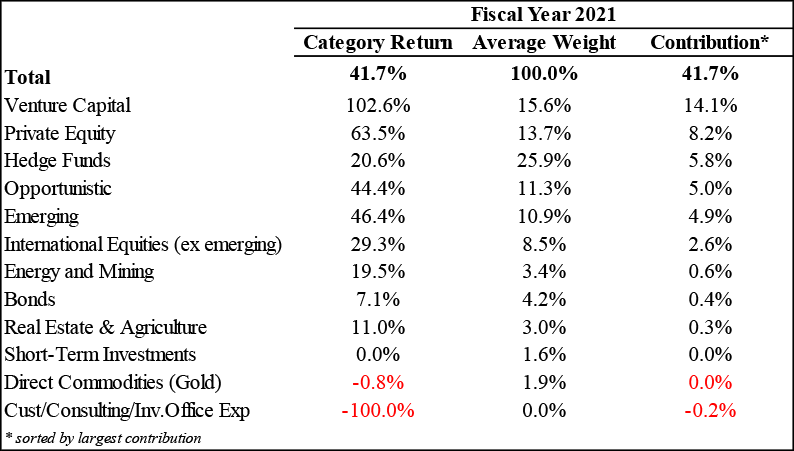

The sources of return for the fiscal year, in descending order by contribution, are shown in the chart below (figures may not foot due to rounding).