The LTIP has ample liquidity, with approximately 55% of its value convertible into cash within one year. This is a modest increase from 50% in 2023.

Fiscal 2024 Report

Fiscal 2024 Report

Report on Investment Performance for the fiscal year ending June 30, 2024

On June 30, 2024, the market value of the University of Rochester’s Long Term Investment Pool (“LTIP”) was $3.5 billion. Performance for the fiscal year was 9.5%, net of all fees and expenses, compared with the benchmark return of 16.5%. The performance of the LTIP exceeded the benchmark for ten years but lagged for one, three, and five years. The recent lag was primarily caused by the rapid increase in the equity benchmark from the price frenzy in the “Magnificent 7” stocks (artificial intelligence) and a slightly negative three-year return on private partnerships. Private partnerships remained the LTIP’s best-performing asset class for five and ten years.

The table below shows the LTIP’s June 30, 2024 allocations compared to targets for calendar year 2024.

The LTIP’s 77% equity-oriented allocation, consisting of public equities, long/short equities, and private partnerships, underperformed the LTIP’s equity benchmark (ACWI) over one, three, and five years, and approximately equaled the benchmark over ten years (8.3% vs. 8.4% on the ACWI). The LTIP was 3% below its equity target for calendar year 2024, partly resulting from partnership distributions exceeding capital calls.

Annualized returns from the LTIP’s 23% diversifier allocation, consisting of bonds, short-term investments, and uncorrelated hedge funds, outperformed all fixed-income benchmarks over one, three, five, and ten years.

For the ten years ending June 30, 2024, annualized volatility was 9.4% for the LTIP and 11.9% for the benchmark. Annualized ten-year volatility for the diversifier allocation was approximately 2.9% and 11.0% for the equity-oriented allocation.

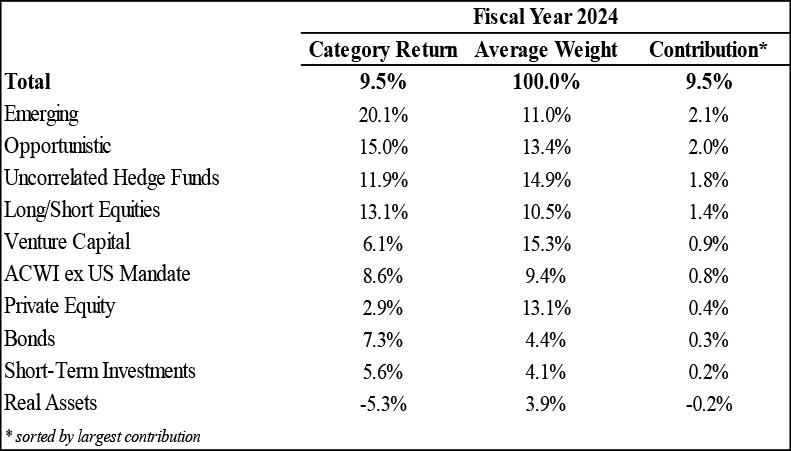

Return attribution for fiscal year 2024 is shown in the chart below.