Fiscal 2025 Report

Fiscal 2025 Report

Report on Investment Performance for the fiscal year ending June 30, 2025

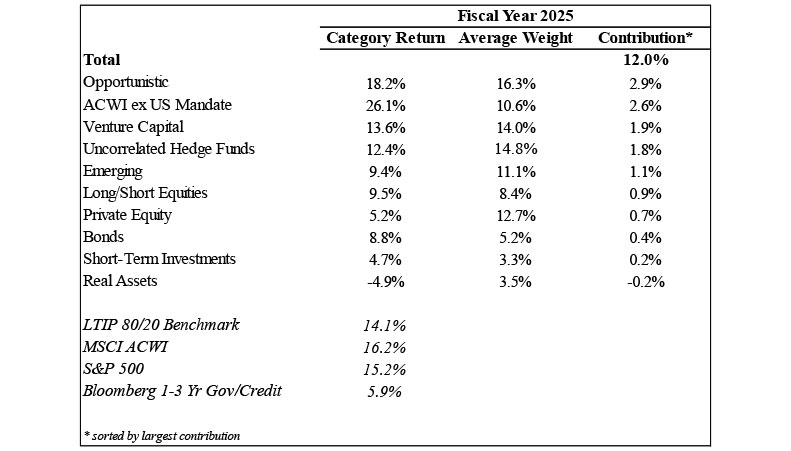

On June 30, 2025, the unaudited market value of the University of Rochester’s

Long Term Investment Pool (“LTIP”) was $3.8 billion. Performance for the fiscal

year ended June 30, 2025 was 12.0%, net of all fees and expenses, compared to

the benchmark performance of 14.1%. The LTIP’s return was 10.4% net annualized

for the most recent five years, which was among the LTIP’s highest five-year

returns. The benchmark returned 11.3% annualized for the five years and was

heavily influenced by the outsized market capitalization of the “Magnificent 7”

in the benchmark. The estimated performance of the LTIP was 8.2% annualized for

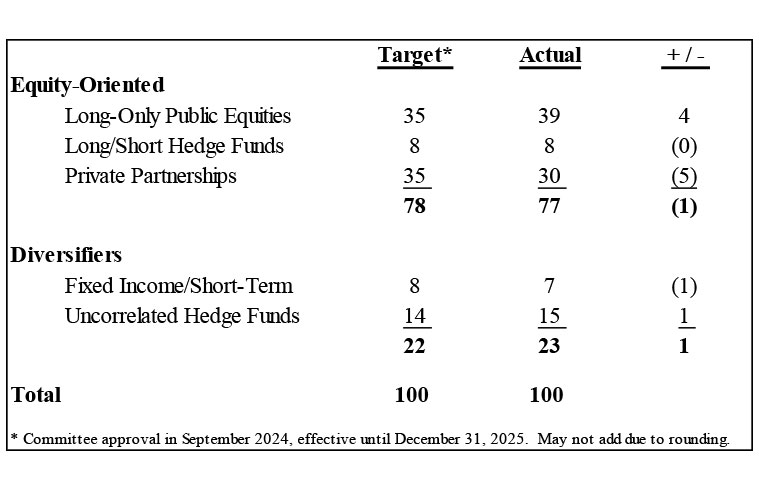

the past decade, versus 8.6% for the benchmark. The table below shows the LTIP’s

June 30, 2025, allocations in comparison to the targets for calendar year 2025.

The LTIP’s sources of return for the fiscal year, in descending order by contribution, are shown in the chart below (figures may not foot due to rounding).