Following an 1,800-point increase during the month of January, the Dow Jones Industrial Average is undergoing some wild swings in February, which included a record 1,100-point drop on Monday.

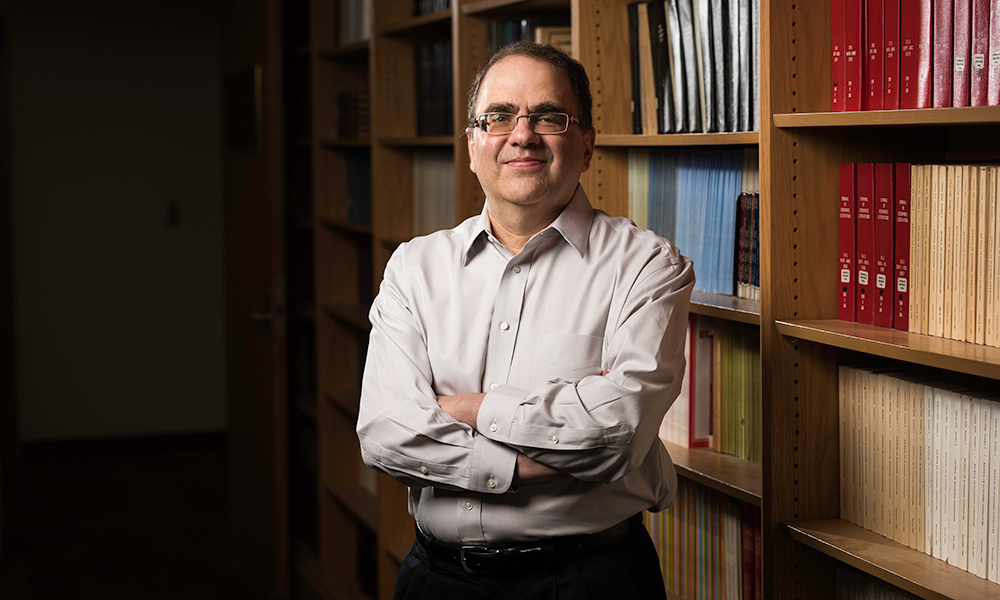

But Narayana Kocherlakota, Rochester’s Lionel W. McKenzie Professor of Economics and the former president of the Federal Reserve Bank of Minneapolis, sees no reason for immediate concern. “After seeing a relatively stable stock market in 2017, we’re now experiencing a burst of volatility,” he says.

Kocherlakota cautions against putting too much weight on the record point drop. “If the base of the market was at 7,000—as it was back during the Great Recession—an 1,100-point drop would represent a 16 percent decline, which is huge. But Monday’s drop comes to only four percent.”

However, when an 1,100-point drop comes a day after a 660-point drop, it is noteworthy. While Kocherlakota can’t point to a single cause behind the two-day “volatility burst,” he believes one factor was the unexpectedly fast growth in wages that took place in January. “That means the Federal Reserve needs to be more concerned with inflationary factors,” he says, “which could prompt them to raise interest rates faster than previously planned in order to put downward pressure on economic activity. Higher interest rates tend to push down on stock prices.”

Kocherlakota emphasizes that the fast growth in wages is just one factor that might explain the recent volatility in the stock market.