Page 10 - Wilson Society Six Strategies - Spring 2023 | University of Rochester

P. 10

Charitable Gift Annuity: Fixed Income for Life

This simple contract provides fixed income for life for one or two

individuals. Cash or securities can be gifted to fund a gift annuity.

The minimum gift amount is $5,000.

ADDITIONAL BENEFITS

• Immediate charitable income tax deduction

• Potential for a portion of income to be tax-free

• Tax avoided on part of capital gain, if funded with

appreciated securities

• Income can be immediate (typically age 50 and older)

or deferred

For more information on gifts that pay you income, visit

www.rochester.giftplans.org and click on “Ways to Give.”

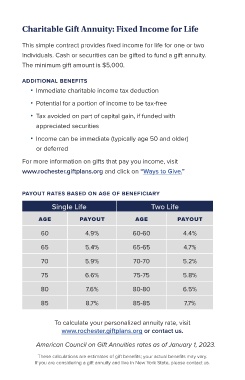

PAYOUT RATES BASED ON AGE OF BENEFICIARY

Single Life Two Life

AGE PAYOUT AGE PAYOUT

60 4.9% 60-60 4.4%

65 5.4% 65-65 4.7%

70 5.9% 70-70 5.2%

75 6.6% 75-75 5.8%

80 7.6% 80-80 6.5%

85 8.7% 85-85 7.7%

To calculate your personalized annuity rate, visit

www.rochester.giftplans.org or contact us.

American Council on Gift Annuities rates as of January 1, 2023.

These calculations are estimates of gift benefits; your actual benefits may vary.

If you are considering a gift annuity and live in New York State, please contact us.