Programs and Perks FAQs

Find answers to frequently asked questions about some of our unique benefits offered through the Total Rewards package, such as tuition assistance, family care, home ownership incentives, and more. Get more information on our Programs and Perks page.

Looking for vision benefits?

We’ve included frequently asked questions about vision care over on our health care FAQs page.

Tuition benefits

For more information, visit our Tuition Benefits page.

To apply for the Employee Tuition Waiver Benefit, log in to myURHR Workday Active Directory, click on ‘Benefits and Pay’ on the homepage under the Apps section, click on ‘Employee Tuition Waiver Application’ under the Suggested Links section

To apply for the Employee Tuition Reimbursement Benefit (for courses outside of the UR), log into myURHR Workday using your Active Directory, click on ‘Benefits and Pay’ on the homepage under the Apps section, click on ‘Employee Tuition Reimbursement Application’ under the Suggested Links section.

To apply for the Dependent Child Tuition Benefit, log in to myURHR Workday Active Directory, click on ‘Benefits and Pay’ on the homepage under the Apps section, click on ‘Dependent Child Tuition Waiver Application’ under the Suggested Links section.

Log in to myURHR Workday, then click on ‘Benefits and Pay’ on the homepage under the Apps section, click on ‘Employee Tuition Reimbursement Application’ under the Suggested Links section. Then, click on the “Attach” button and upload your proof of completion (e.g., grade report or certificate), proof of cost, and proof of payment (e.g., billing statement/deferment form) directly to your application. Then, hit submit, and your documents will be routed to the Office of Total Rewards for review.

Yes, as long as, the non-credit courses are taken at a college or university and meet the criteria of being directly job-related, having at least 15 contact hours, having outside readings and assignments, and having a formal evaluation based on a final exam.

No, only full-time service can be counted towards service requirement for the 10-year Dependent Children Tuition Waiver Benefit. This service requirement may be met by full-time service at another college or university that offered a tuition benefit plan for dependent children for which the faculty or staff member was eligible. To receive credit for full-time service completed at another college or university, please complete a Tuition Benefits Service Credit Form and submit it to the Office of Total Rewards for review within 30 days from the start of the course(s).

Graduate tuition assistance benefits up to $5,250 in a calendar year are not taxable. Graduate tuition assistance benefits that exceed $5,250 in a calendar year are taxable wages unless the course satisfies the requirements for a tax deductible job-related course under IRS rules. Generally, a job-related course will satisfy these IRS requirements if it maintains or improves skills for the individual’s present job, or if the course meets the employer’s express requirements for retaining the job, and the course is not part of a program that will qualify the individual for a new trade or business. For taxable tuition assistance benefits, applicable Federal and State income taxes and FICA taxes will be deducted from the employee’s paycheck when the waiver is approved or the reimbursement is paid to the employee. In addition, the taxable income will be reflected on the W-2 for the calendar year when the actual tuition benefit is posted to the student’s account or reimbursed to the employee. Please also review the content on this page for more details.

If you believe that your proposed graduate level course(s) and/or non-credit course(s) satisfies the requirements for a tax deductible job-related course under IRS rules, follow these instructions:

For the employee tuition waiver benefit, answer all the applicable questions on the online Employee Tuition Waiver application available in myURHR Workday.

For the tuition reimbursement benefit, answer all the applicable questions on the online Employee Tuition Reimbursement application available in myURHR Workday.

Home Ownership Incentive Program

Regular full-time and part-time faculty and staff, residents, and fellows* are eligible for the University Home Ownership Incentive Program upon appointment, as long as your total household gross income was less than *$150,000 in 2023 for Calendar Year 2025 applications.

*You are not eligible for the University Home Ownership Incentive Program if you are a postdoctoral fellow, postdoctoral research associate, postdoctoral teaching fellow, EDC Associate, or visiting faculty.

No, but you do need to be a first-time homeowner in the City of Rochester (current City homeowners are not eligible).

No, the University Home Ownership Incentive Program is “all or nothing.” You must be approved for the $10,000 forgivable loan from the University of Rochester, the $5,000 City grant, and the $5,000 grant/lender credit from a participating lender.

No, the $20,000 benefit is per mortgage.

You will need your University Active Directory login to access the application. This application requires Duo two-factor authentication when connecting from outside the University’s networks.

Application

- You will need your University Active Directory login to access the application. This application requires Duo two-factor authentication when connecting from outside the University’s networks.

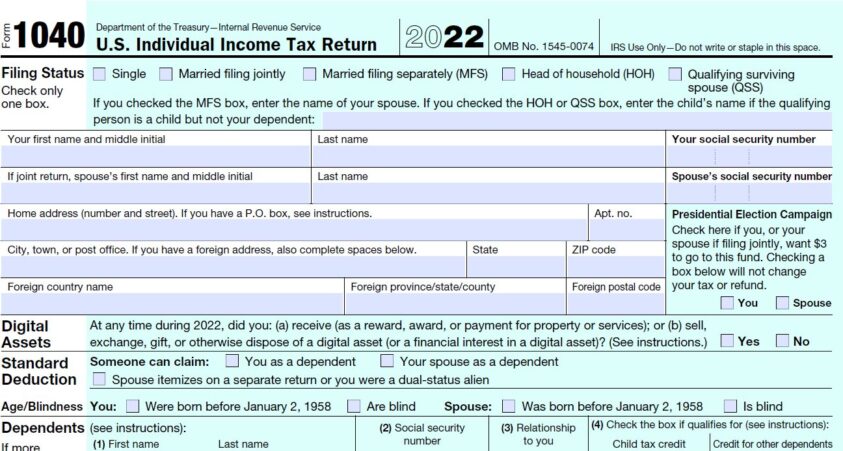

- 1040 (page 1 and page 2 of your 2023 IRS form 1040 as well as that of your spouse, if filed separately). This is not your paystub, W-2, or tax transcript.

All employees applying for the University Home Ownership Incentive Program must certify that all the information they have provided is truthful and correct to the best of their knowledge.

If you don’t have a 1040, please email Homeprogram@rochester.edu.

Your household gross income is an initial eligibility requirement. If your household gross income increases over the initial annual threshold after you close on a home through the University Home Ownership Incentive Program, you will not have to repay any portion of the benefit.

The University’s $10,000 loan becomes taxable when and to the extent that it is forgiven.

| Time Elapsed | 5-year Repayment Percentage |

| 1st month through 24th month | 100% |

| 25th month through 36th month | 75% |

| 37th month through 48th month | 50% |

| 49th month through 60th month | 25% |

| 61st month | 0% |

Upon termination, change to an ineligible status, and/or sale of your home, if you have not satisfied the employment requirement (5 years after closing) and residency requirement (5 years after closing), you must repay the $10,000 loan immediately (repayment amount will be prorated)

| Time Elapsed | 5-year Repayment Percentage |

| 1st month through 24th month | 100% |

| 25th month through 36th month | 75% |

| 37th month through 48th month | 50% |

| 49th month through 60th month | 25% |

| 61st month | 0% |

Your initial approval will not expire until April 30 of the following year (as long as you maintain active, benefits-eligible employment at the University of Rochester). If you cannot close on an eligible home until after April 30 of the following year, then you will need to re-apply for this benefit and be subject to the new total household gross income amount at that time.

No, for 2025 applications, we can only accept your 2023 IRS Form 1040 to prove income eligibility.

Form 1040 is an IRS tax form used for personal federal income tax returns filed by United States residents. The form calculates the total taxable income of the taxpayer and determines how much is to be paid to or refunded by the government. These documents are usually prepared by a tax specialist (see example below).

Life insurance

For more information, visit our Life insurance page.

GUL insurance pays a death benefit and allows for contribution of additional premiums beyond the cost of the insurance. Furthermore, Lifestyle Benefits are automatically included in the plan. These benefits consist of: travel assistance, legacy planning resources, and beneficiary financial counseling (employees only covered under the University-Paid Basic Term Life insurance also have access to Lifestyle Benefits).

Log in to myURHR Workday. Click on the “Benefits and Pay” link on the homepage under the Apps section. Click on “Securian Financial Life Insurance” under the Suggested Links section.

Or

Log on to Securian Financial’s website, www.lifebenefits.com, and follow the instructions below:

- User ID: UR + Your 6-digit employee ID number (e.g., UR123456)

- Initial password: Your 8-digit date of birth, followed by the last 4-digits of your Social Security Number (e.g., 012319011234)

You may apply at any time for GUL insurance. Some guaranteed amounts of coverage are available—no medical exam is required—if you apply within the first 90 days of eligibility for coverage under the plan, within 90 days of a family status change or during annual open enrollment (if eligible). Proof of good health is required for any life insurance election made outside of the above mentioned enrollment windows.

Use Securian’s online life insurance decision tool, Benefit Scout™, to help you and your family determine how much life insurance you need and what it will cost, so that you can make your insurance elections with confidence. Log in to myURHR Workday with your Active Directory Click on the “Benefits and Pay” link on the homepage under the Apps section. Click on “Securian Financial Life Insurance” under the Suggested Links section. Then, click on “Get started” and Visit Benefit Scout™.”

Long-term care insurance

For more information, visit our Long-Term Care Insurance page.

All benefit eligible and non-benefit eligible faculty and staff may apply for long-term care insurance. In addition, family members of faculty and staff are eligible to apply. All applicants must complete a Statement of Health and be approved by the insurance carrier before a policy will be issued.

MetLife Legal Plans

For more information, visit our YOUR Benefits Extras page.

New hires and newly eligible faculty and staff have 30 days from their hire/eligibility date to enroll. You can also enroll in the legal plan during open enrollment.

Yes, your premium for the legal plan ($18.25/month) will be an after-tax payroll deduction.

Yes, MetLife Legal Plans will mail you a letter upon your enrollment, which will include your MetLife-generated membership number. When you are ready to use the legal plan, simply give MetLife Legal Plans a call at (800) 821-6400 or log on to the members’ website, members.legalplans.com using the last four digits of your membership number and your zip code, and use our Attorney Locator to find an attorney near you. Once you’ve found an attorney, click on “Obtain Case Number” to get a case number to provide to the attorney when you call to make an appointment.

Coverage for MetLife Legal Plan will be continued during a Leave of Absence, Long-Term Disability, Layoff, Worker’s Compensation or NYS Paid Family Leave for up to 90 days from the start of your unpaid leave. If you return to work in an active, benefit-eligible position within 90 days from the start of your unpaid leave, Corestream will recoup any missed premiums by double deducting your premium in your paycheck(s) until the deficit has been recouped. If you do not return to an active, benefits-eligible position within 90 days from the start of your unpaid leave, you may elect to continue the MetLife Legal Plan by applying for portable enrollment for up to 12 months on a direct-bill basis with the provider.

Family care

For more information, visit our Family Care page.

The University of Rochester’s child care subsidy was created to help eligible faculty and staff pay for dependent care expenses by granting awards of up to $3,600/year per household based on total household gross income.

You are eligible if you meet the following criteria:

- You are a regular full-time or part-time faculty or staff, non-SEIU staff, Strong Memorial Hospital resident or fellow, or Postdoctoral Associate (job code 0093); Individuals covered by collective bargaining agreements receive benefits in accordance with those agreements (SEIU members are not eligible).

- Based on IRS publication 503, you have a legal dependent child under age 13 whom you claim as a tax dependent on your federal income tax return (special rules apply for divorced parents), or any other dependent child on your tax return who resides with you and is physically or mentally disabled and will have estimated child/dependent care expenses during the enrolled calendar year or period.

- Based on IRS publication 503, you are unmarried, or have a spouse who meets one of the criteria below:

- Employed at least part-time

- A full-time student

- Considered legally disabled

- Looking for work

- Have a total household gross income of less than $150,000 in 2023 (amount is subject to annual indexing) for Calendar Year 2025 (line 9 on your 1040).

Based on IRS publication 503, you have a legal dependent child under age 13 whom you claim as a tax dependent on your federal income tax return (special rules apply for divorced parents), or any other dependent child on your tax return who resides with you and is physically or mentally disabled and will have estimated child/dependent care expenses during the enrolled calendar year or period.

Awards are limited to one per family/household, so only one person may apply.

Apply Now (only open to new hires or those with a qualifying life event)

You will need your University Active Directory login to access the application. This application requires Duo two-factor authentication when connecting from outside the University’s networks.

Application Window for Calendar Year 2025 is now closed

New hires and qualifying life events can apply outside of the Annual Application Period as defined for the Dependent Care FSA.

Application Window for Calendar Year 2025 is now closed

Only new hires and those with qualifying life events can apply outside of the application window. New Hires have 30 days post hire to submit a child care subsidy application.

Within 60 days of a qualifying event (family status change), you may apply for the Child Care Subsidy. The full list of qualifying events and their corresponding changes can be found here.

- Required Documents for Calendar Year 2025 (Only for new hires or qualifying events):

- Application

- You will need your University Active Directory login to access the application. This application requires Duo two-factor authentication when connecting from outside the University’s networks.

- 1040 (page 1 and page 2 of your 2023 IRS form 1040 as well as that of your spouse, if filed separately). This is not your paystub, W2 form, or tax transcript.

- Dependent Information Change Request Form if dependent(s) is/are not in myURHR Workday.

- Application

Additional supporting documents may be requested to confirm eligibility. All employees applying for subsidy must certify that all of the information they have provided is truthful and correct to the best of their knowledge.

If you don’t have a 1040, please email familycare@rochester.edu for next steps.

- Only qualifying child care expenses under the Internal Revenue Code may be reimbursed with the subsidy. Generally, qualifying expenses are limited to child care expenses that you incur to enable you and your spouse to be gainfully employed. A discussion of qualifying expenses can be found in IRS Publication 503, but could include infant and toddler child care, pre- school/pre-K programs, care on school holidays, school-age summer day camps/programs, and school-age before/after school care.

- Your child care provider cannot be your spouse or dependent.

- Your child care provider must provide a Tax Identification or Social Security number and must report the child care income on their tax return.

- Your child care provider does not need to be a licensed facility, as long as the care provider reports the income on their tax return.

- Please note: You can only submit expenses for the time period you were enrolled in the plan in the given calendar year.

Yes. This is an annual award and you will need to reapply each year during the given application window.

New hires and those with a qualifying life event (which includes birth/adoption) are eligible to apply outside of the application window.

- Yes, your dependent(s) do not need to be covered under the University’s Health Care Plans

- If your child is not listed as your dependent in myURHR Workday, you will need to submit a Dependent Information Change Request Form to have them added

- This does not affect your insurance or coverage

For Calendar Year 2025:

- Total household gross income is less than $87,000: Subsidy is $3,600/year ($300/month; $150/semi-monthly pay period; $138.46/biweekly pay period)

- Total household gross income is between $87,000 and $115,999.99: Subsidy is $2,400/year ($200/month; $100/semi—monthly pay period; $92.31/biweekly pay period)

- Total household gross income is between $116,000 and $149,999.99: Subsidy is $1,200/year ($100/month; $50/semi-monthly pay period; $46.15/biweekly pay period)

If you apply and are approved for the Child Care Subsidy, you will automatically be enrolled in the Dependent Care FSA.

If you are eligible and you plan to make voluntary contributions to your Dependent Care FSA, you can do so during Open Enrollment. Please keep in mind that the total of your subsidy award plus your contribution cannot exceed the maximum annual total of $5,000 per family (or $2,500, if you’re married and file taxes separately).

You will be reimbursed through your Dependent Care FSA after costs have been incurred.

The child care subsidy is a reimbursement program through the Dependent Care FSA. You will only be reimbursed up to your award amount, OR your total eligible child care costs if these are less than your award.

Lifetime Benefit Solutions (LBS) administers dependent care claim reimbursements for the University of Rochester Child Care Subsidy Program based on the same rules and regulations governing Dependent Care FSAs.

You can submit a claim via the Lifetime Benefit Solutions member portal or mobile app. You also can complete a claim form and mail it to Lifetime Benefit Solutions. If you have not previously logged into your Lifetime Benefit Solutions account, please see the new user instructions.

You can find step-by-step instructions under “How to Claim a Subsidy”.

Funds will be available on a pro-rated basis throughout the calendar year or enrolled period within the calendar year. For example, if approved for a scholarship of $2,400, $200 would be available each month; $100 semi-monthly; $92.31 biweekly. Funds are deposited into your Dependent Care FSA on/around each pay period check date.

Once you start incurring costs within the calendar year, you can submit for reimbursement via Lifetime Benefit Solutions. You will only be reimbursed up to your award amount, OR your total eligible child care costs if these are less than your award.

If you receive a mid-year award, please keep in mind that you can only submit expenses that occurred during the time period you were enrolled in the plan in the given year.

You may be eligible to make additional contributions to your Dependent Care FSA from your wages on a pre-tax basis, as long as the total of the subsidy plus your contribution does not exceed the maximum annual total of $5,000 per family (or $2,500, if you’re married and file taxes separately).

No. Postdoctoral Associates are not eligible to make voluntary contributions into Dependent Care FSAs. Please refer to the benefits summary for more details.

Your child care subsidy award as well as any voluntary dependent care FSA contributions will be reported in Box 10 on your W-2. You should consult with your personal tax advisor regarding any tax impact for you, particularly if you do not claim the entire award you receive. Please review IRS Form 2441 with your personal tax advisor in determining how to account for your Dependent Care FSA benefits.

Unpaid Leave of Absence: Child Care Subsidy Award payments will stop as of the effective date of the unpaid leave. When you return to work in a benefit-eligible position, if you wish to re-elect the Child Care Subsidy, you must contact Total Rewards within 30 days of your return. You will have 120 days beginning January 1 following the end of the plan year to submit eligible expenses incurred during the plan year in which your plan was terminated.

Paid Leave of Absence: Child Care Subsidy award payments would continue during an employee’s paid leave of absence.

Terminate or Change to an Ineligible Status: Child Care Subsidy Award payments stop as of your termination date or change to an ineligible status. The amount available for reimbursement is limited to the amount credited to your Dependent Care FSA, less any prior reimbursements. You will have 120 days beginning January 1 following the end of the plan year to submit eligible expenses incurred during the plan year in which your plan was terminated.

No. After the end of the year, you will have 120 days, beginning January 1 of the current plan year, to submit any remaining claims for qualified services incurred in the previous plan year.

You will have 120 days, beginning January 1 of the current plan year to submit any remaining claims for qualified services incurred in the previous plan year.

Please apply for the Faculty/Staff Child Care Subsidy. Applications are limited to one per household.

Please email familycare@rochester.edu or call 585-276-5748 with any questions.

If you have any questions on how to file your dependent care claim or how to access the Lifetime Benefit Solutions member portal and mobile app, please contact Lifetime Benefit Solutions Customer Service at 800-327-7130 or LBS.CustomerService@LifetimeBenefitSolutions.com.

Eligibility for this benefit includes regular full-time and part-time faculty and staff, non-SEIU staff, Strong Memorial Hospital residents and fellows, and Postdoctoral Associates (0093); Individuals covered by collective bargaining agreements receive benefits in accordance with those agreements (SEIU members are not eligible).

Log in to your Care.com account by visiting universityofrochester.care.com or downloading the Care.com app on your mobile device. You will log in using your name and University of Rochester Employee ID number (this can be found on your myURHR Workday profile).

You may search, schedule, manage, and pay for care by reviewing postings of available providers or placing your own advertisement for:

- After-school sitters for those 3pm pick-ups

- Getting Fido a walker while you’re working

- Arranging back-up care when your regular sitter isn’t available

- Helping mom and dad at home with a senior caregiver

- House need some love? Find a housekeeper

- Finding a tutor to help your kiddo with classwork

- Personal assistants, special needs, and more

Care.com offers tools and resources to help you evaluate risk and stay savvy about safety. See care.com/safety to access safety guides, background check options, and Safety FAQs.

The University of Rochester is providing eligible employees a membership to Care.com as an employee benefit. Employees are under no obligation to use the services provided by Care.com. Employees are responsible for understanding Care.com’s terms of use. The University is not responsible for any issues an employee may experience in the use of Care.com’s services or with any care provider hired through such service.

You can pay caregivers directly or enroll in the Care.com HomePay service.

Yes, visit universityofrochester.care.com and click on “Enroll Now.” You’ll be asked whether you have an existing membership. Select “Yes” and proceed with logging in. Contact Care.com at (855) 781-1303 regarding reimbursement of unused time on your previous paid membership.

Register here for your free Care.com premium membership. You will need your employee ID.

The credit card you have on file will be charged after care takes place. Part of your Backup Care is subsidized, so you are only responsible for your co-pay.

- The benefit is 10 Backup Care days per year

- In-Home Backup Care Services have a minimum reservation of four (4) hours per day and a maximum of ten (10) hours per day. Requests for more than ten (10) hours of In-Home Backup Care Services will count as a second day of care.

- Out-of-Home Backup Child Care Services have a minimum reservation of one (1) day.

- Tier 1 (full-time faculty and staff earning less than $105,400 and Residents & Fellows)

- $4 per hour in-home and $15 per day in-center

- Tier 2 (full-time faculty and staff earning $105,400 or higher and all part-time employees)

- $8 per hour in-home and $25 per day in-center

When there is an emergency, unforeseen disruption of their regular care, or a planned day when extra assistance is needed.

Backup Care is not intended as a replacement for routine childcare arrangements.

Once you’ve registered for your free Care.com premium membership, you can quickly and easily request Backup Care:

- Start your request for Backup Care either online, through the Care.com app, or by calling (855) 781-1303.

- Choose your preferred option for care: in-home or in-center.

- Care.com will match you to a caregiver.

Personal Network Backup Care allows you to identify and use care providers that you select on your own. For example, you might choose a familiar individual, business or service provider. Personal Network care providers are not evaluated, vetted, recommended, or employed by Care.com or its affiliates.

The eligible employee must submit a claim within one month of using Personal Network Backup Care. The eligible employee’s co-pay amounts (the same tiers as for Backup Care) will be deducted from the total claim for reimbursement reported by the eligible employee, and provides a reimbursement of up to $125/day.

Please keep in mind, once an employee terminates or becomes ineligible they will not have access to their premium membership and will not be able to submit for reimbursement.

The Care.com team will work quickly to identify a caregiver or child care center that meets your specific needs.

- For in-home care, a Care.com specialist will call you directly about your caregiver to confirm the details.

- For in-center care, a Care.com specialist will confirm your reservation in an email that includes details about the center.

Response times can vary based on the ability to find care. Typically, you will receive confirmation no later than 7:00pm the day prior to the care needed if the request is made over 24 hours in advance.

In-center Backup Care can be requested up to 30 days in advance, or care can be requested for urgent last-minute care. Care.com cannot guarantee 100% of requests to be filled, so it’s best to book Backup Care as soon as you know you have a need so Care.com can secure a provider or center that meets your needs.

Once a placement is made, you will receive an email notification confirming the requested job. As a reminder, you also always have the option to use Personal Network Backup Care and submit a receipt for reimbursement to Care.com after care has occurred.

A $30 cancellation fee will be assessed if a Backup Care request is cancelled within forty-eight hours of the Backup Care reservation start time and a Backup Care provider already had been reserved to fulfill the Backup Care request.

In addition, if the cancellation occurs within twenty-four hours of the Backup Care reservation start time, one day will be deducted from the eligible employee’s Allotted Backup Care Service Days (10 days per year).

All individuals performing In-Home Backup Care for children must complete a Backup Care services orientation and screening process that includes a criminal background check, a National Sex Offender Public Website check, a Social Security Number trace, identity verification, and reference checking.

All individuals performing In-Home Backup Care for adults—which may include certified nurse’s aides, home health aides, or experienced elder care companions—must complete a screening process that includes a criminal background check in accordance with state guidelines and reference checking.

Providers of In-Center Backup Child Care—including traditional child care centers or family child care centers (FCCs)—are licensed or registered in accordance with applicable law. Their respective employees and staff are selected by such providers and also screened in accordance with applicable law, which includes, at a minimum:

- National Sex Offender Registry check

- Central Abuse and Neglect Registry check

- Confirmed eligibility to work in the U.S.

In-home Backup Care can be used for mildly ill children, however, it cannot be used for children with a fever equal to or great than 100 degrees, or for children with a contagious illness or condition, such as cold/flu, chicken pox, untreated strep throat, conjunctivitis or head lice. Additionally, if a child may have been exposed to COVID-19, we cannot provide care until the dependent/family has been quarantined for 10 days from the date of exposure, the onset of symptoms, or a positive test. Personal Network backup care is also available to circumvent the limits of in-home sick care by providing employees with the freedom to use caregivers in their own network (e.g., regular babysitter, family members, friends, etc.) and to submit for reimbursement after care has occurred. Employees make arrangements with caregivers in their network directly (it is their responsibility to inform the caregiver of any illness, requirements, arrangements, etc.) there is no pre-approval needed, so employees can begin finding care as soon as they realize their child is sick.

In-Center Backup care is not available for sick children. Children will be in close proximity to other children while being cared for at a Backup Care center. To help ensure any illnesses will not be spread among them, sick children are not eligible for In-center Backup Care.